One of the most common questions I hear about personal finances is "Where do I start?"

When just coming around to the idea that your finances need some serious attention, and you go looking for help, what you find can be completely overwhelming.

Debt Snowball, Debt Avalanche, paycheck budgeting, zero based budgeting, cash envelopes, and on and on.

You get so full of information that your head is just spinning and you just don't know what to do first.

So I created a Spending Tracker to give a simple starting place to those brand new and overwhelmed.

Why a Spending Tracker first? Because you have to know where you are right now before you can make a plan to do something different, and it's EASY to fill in, even if you've never paid attention to your money at all.

The reason I love this page? The "Why" column, and the last two N/W and P/U columns.

Writing down WHY you spent the money can give you great insight into what's going on when you overspend.

N/W is Need/Want and P/U is Planned/Unplanned. When your sheet has multiple items that are Unplanned Wants, that's likely an issue that needs attention. Unplanned Needs are probably a good indicator of a sinking fund that needs to be started.

I’ve also included a section at the bottom to categorize (I love categorizing with different colored highlighters) and tally up the totals for each category.

Use one tracker a week for four weeks and see with new clarity where (and why) your money leaks are happening.

Or continue to use every week as part of your budgeting system.

You can get a Free Spending Tracker HERE.

And then it Grew

After I made the free Spending Tracker (and gave away hundreds and hundreds of them) I got requests for some other pages.

I started doing some research into what types of budget planner packs were available, thinking I could find some to recommend.

I found lots of them, but I noticed some things right away about them all.

There were some that were beautifully designed but very basic, with just a handful of pages (sometimes even the same page repeated 12 times to "pad" the page count). That tells me that the designers are great at design, but maybe not so great at the actual content.

There were some bigger sets with more detailed pages, but design-wise I felt they left a lot to desire. They were either way overdone (different fonts and colors and patterns everywhere), completely childish, or, sorry to say, just plain ugly (and who wants to use ugly pages?). I'm guessing many of these designers had great ideas for what kinds of pages to include, but the execution of design just isn't there.

I even found some that were so color saturated that it would take a full ink cartridge just to print all the pages. These could work great if you are going digital only, but I want to be able to print the pages to use by hand.

True, a financial binder doesn't have to have to be attractive to do the job, but if doing the job isn't enjoyable for you, adding something pretty or fun or inspiring to the task makes a big difference.

That's when I realized that perhaps I'm not like other printable designers out there. I'm this odd mix of both left brain and right brain. Very creative, but also very logical. I was a graphic designer for years, so I have the experience and eye to create well designed pages. While my logical side sees where basic financial planner pages fall short in how they function.

Plus my years of getting out of debt and working on my relationship with money have taught me that winning with money isn't just about the numbers. (In fact, I find that it's more about the emotional side for many people than it is about the numbers.)

So since I wasn't finding anything to recommend, I set out to design a pack of pages myself, and I had four very important criteria.

-

Beautiful, clean design (that made my fingers itch to fill them out)

-

Highly functional (practical and useful pages, with enough detail to be precise but not so much to make them tedious)

-

Comprehensive (no more having to search all over the place and piece together a bunch of different printables with different designs, looking all jumbled and disorganized. I like my things to all look the same, don't you?)

- Low ink use (so you can print all the pages without draining your ink cartridge)

I asked my customers what they wanted to see in a big pack of budget & financial pages, and got a ton of requests, and those requests spawned more ideas.

I ended up with a list of over 65 unique pages.

Woah.

Was that just tooo much? I mean, talk about overwhelm! No one wants, or needs, over 65 pages to keep their financial life in order.

So what to cut out?

The Retirement and Credit Score trackers?

The Travel and Back to School Budgets?

The Online Sales or Subscription trackers?

I just could not justify pulling anything out, because while not every page applies to everyone, all the pages are useful to some.

So I decided to include all the pages, but price it as if it were much smaller, so even if you don't use them all, it's still a great price.

I sell individual pages for $2, that puts the value of the pack at $140! (which you'll more than make up for in the improvement in your finances), but I've priced the whole pack at just $29.

Use the Discount Code BFPBLOG20 to get $20 off the regular price. That's all 65+ pages for just $9!

What's Included

I've clustered the pages into five groups:

Goals

Vision Board, Big Picture Overview, Long Term Goals, Quarterly Goals, Goal Action Planner, Goal Review, Wins Wins & More Wins, Ideas, Plans & Notes

Budget

Monthly Income Sources, Monthly Budget, Paycheck Budget, Money Flow Calendar, Money Flow Calendar 2 page, Weekly Money Plan, Weekly Spending Tracker, Yearly Bill Payment Checklist, Yearly Expenses, Subscriptions Tracker, Surprise Money Priority Plan, Budget Review, Budget Review Notes, School Supplies Budget, Christmas Budget, Gifts Budget, Travel Budget, Moving Budget, Blank Budget, Food at Home Inventory, Meal Plan & Shopping List

Debt

Debt Priority Worksheet, Debt Payoff Plan Tracker, Yearly Debt Payoff Tracker, Debt is Going Down, Mortgage Payoff Tracker

Savings

Emergency Fund Tracker, Special Events to Save For, Yearly Savings Tracker, Sinking Funds Master List, Sinking Funds Tracker, Savings Goal Tracker, Snowflake Savings Chart, Retirement Contributions Tracker, Retirement Balance Graph

Other Stuff

One Line a Day Journal, Money Journal Prompts, Money Journal, Accounts Information, Net Worth Worksheet ,Net Worth on the Rise, Online Sales Tracker, Mind the Gap, Credit Score Tracker, Soar that Score, Donations Tracker, Fun Money Wishlist, Future Needs Wishlist, Child Support Tracker, Blank Graph, Cash Envelopes, Printable Stickers

Now I get it. That's a LOT of pages.

To keep from being overwhelmed, and not knowing where to start, I've included a Quick Start guide with recommended pages to start with depending on your specific situation.

Printing Tips

Once you've downloaded the PDF file, simply open it up, scroll through to see which pages you want to print, and select those pages in the Printer menu.

Keep in mind these are designed to be easy on the ink use, so if you print in an "ink saver" or "draft" mode, they will likely print very lightly. I actually recommend using the regular print setting, or even enhanced if you have the option.

Don't have a printer (or out of ink?) no problem. I got the entire pack printed in black and white at my local office supply store for about $11. Check your local office supply store's website to see if they offer printing services. My store has the option to upload the file to their website and pick up in the store, or they also have DIY copiers that take USB sticks (which saves even more if you have the time to stand there and do it yourself).

You can even print these in smaller sizes to use as inserts in your current planner. Here's how.

My Favorite Pages

So many favorites in this pack, it's hard to narrow it down, but here are six faves that you won't find anywhere else.

Big Picture Overview

I love seeing all my progress on a single page. This Big Picture Overview page has spaces for tracking 12 months worth of progress in six different areas of your finances. Such a great page to keep at the front of your budget binder.

Monthly Income Sources

We all need to be reminded that money doesn't just come from our paychecks. Even finding a few coins on the ground is something I like to be very aware of. I call those coins "Pennies from Heaven", and they remind me that there is always more money coming into my life. This page will help you notice ALL the money you have available to put to work toward your goals.

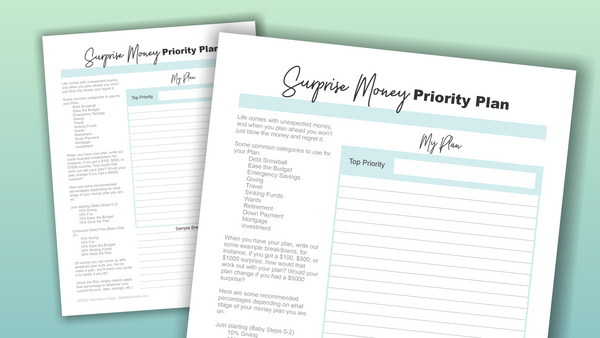

Surprise Money Priority Plan

I had to include a page for this. This is something we did multiple times while getting our money in order, because I noticed something going on. When unexpected, or "surprise" money would show up, maybe a tax refund or a gift or selling something unexpectedly, we tended to think of that money as "extra" and would just go spend it, like immediately. And poof, it was gone. I didn't like that. So we sat down and dreamed a little. What would we do if $1000 just showed up for no reason? What would we do if we got a $10,000 inheritance from a distant relative? We decided ahead of time on some percentages of where the money would go IF any showed up. And when it did (it always does, even if it's just $20) we were much less likely to just "blow it" on something silly in the moment.

Weekly Spending Tracker

This is the page that sent me down a new path of other printable pages, and is still one of my very favorites. The reason I love this page? The "Why" column, and the last two N/W and P/U columns. Writing down WHY you spent the money can give you great insight into what's going on when you overspend. N/W is Need/Want and P/U is Planned/Unplanned. When your sheet has multiple items that are Unplanned Wants, that's likely an issue that needs attention. Unplanned Needs are probably a good indicator of a sinking fund that needs to be started.

Debt Priority Worksheet

I love this page because it gives a method to figure out what to pay off first. It can be so hard to decide which method is best, Debt Snowball? Debt Avalanche? Something else? To figure out our plan I basically did what I've recreated on this sheet. I ranked our debts by interest rate, by amount, and by annoyance, then put them in custom order for us. Ours ended up mostly in Debt Snowball order, with a few variations, and it was just right for us. You can figure out what is just right for you with this page too.

Emergency Fund Tracker

One big lesson I learned getting out of debt, is that the Emergency Fund is NOT a savings account. The purpose of it is not to have $1000 in the bank and never touch it. The purpose is to break the habit of using the credit card for emergencies like car repairs, or unexpected bills, or last moment travel when family needs you. Therefore, the Emergency Fund balance WILL go up and down, a lot at the very beginning, as you learn to not use the credit card and start saving up ahead for upcoming expenses. In time, the up and down movement will lessen as your sinking funds fill up. You won't have to use the Emergency Fund for getting the brakes fixed if you have a car maintenance sinking fund. Use this page to record both deposits and withdrawals from your Emergency Fund.

Snowflakes Savings Challenge

One snowflake, on it's own, doesn't amount to much. But pile it up and you can make snowballs, snowmen, even snow houses. This page is a way to see that small amounts. gathered over time, can make a big difference. Challenge yourself to save even a small amount, regularly, and see how much it adds up to.

And that's just a handful of the over 65 pages in the Big Finance Pack. There are a whole lot of other great pages too, but I had to cap my list or I'd just keep going on and on.

Use the Discount Code BFPBLOG20 to get $20 off the regular price. That's all 65+ pages for just $9!

Once you start using the pages in this pack to get your finances in order, you won't know how you ever got along without it! Click here to get your copy today.

Not ready to get it today? Pin it for later so you can find it again.

![]()