I'm sharing with you the Surprise Money Priority Plan from my Big Finance Pack FREE!

You can find the entire Big Finance Pack HERE.

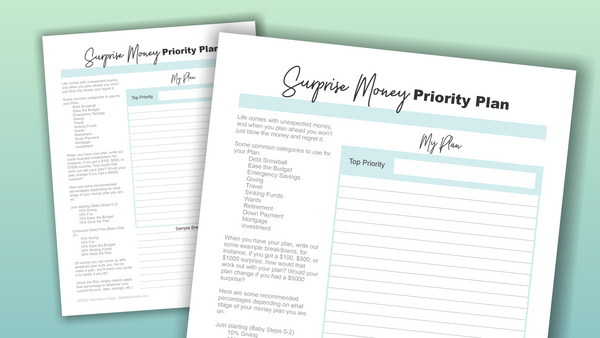

Surprise Money Priority Plan

I had to include a page for this. This is something we did multiple times while getting our money in order, because I noticed something going on.

When unexpected, or "surprise" money would show up, maybe a tax refund or a gift or returning something, we tended to think of that money as "extra" and would just go spend it, like immediately. And poof, it was gone.

I didn't like that.

So we sat down and dreamed a little.

What would we do if $100 just showed up for no reason? What about $1000? What would we do if we got a $10,000 inheritance from a distant relative?

We decided ahead of time on some percentages of where the money would go IF any showed up. And when it did (it always does, even if it's just $20) we were much less likely to just "blow it" on something silly or meaningless in the moment.

This one thing alone made a huge difference in how long it took to get out of debt.

"Planning for future unexpected money has been revolutionary for me." - Brianna

How to Use the Surprise Money Priority Plan

You don't have to send all the Surprise Money to debt or to savings, you can spend it all if you want, but without a plan you'll probably spend it on stuff that doesn't really matter. This page is to help you decide what matters.

When making our plan, we looked at the budget and considered what was most important to us, and it wasn't always to go to the Debt Snowball.

Consider what is important to you and make a custom plan. Some items that might be in your plan:

- Debt Snowball

- Ease the Budget - add a little to your tight budget categories

- Emergency Fund

- Giving

- Travel

- Sinking Funds - for known upcoming expense like Property Taxes

- Wants (specific wants, or just a "wants" fund)

- Retirement

- Down Payment

- Mortgage

- Investment

When you have the categories chosen for your plan, write out some example breakdowns. For instance, if you got a $100, $500, or $1000 surprise, how would that work out with your plan? Would your plan change if you had a $5000 surprise?

Percentages Plan

Here are some recommended percentages depending on what stage of your money plan you are on.

Just starting (Baby Steps 0-2)

10% Giving

10% Fun

10% Ease the Budget

70% Work the Plan

Consumer Debt Free (Baby Step 3+)

10% Giving

10% Fun

10% Ease the Budget

40% 6 Month Emergency Fund

30% Sinking Funds

(Work the Plan simply means apply that percentage to whatever your current focus is, getting current, emergency fund, debt, etc.)

This takes a lot of decision making out of your hands and lets you just follow the plan, which makes it less likely you'll make a rash decision.

Click HERE to download the Surprise Money Priority Plan

If This then That Plan

Another way to make this work for you if percentages aren't your jam, is to make a list of the "wants" you'll buy if you get a certain amount.

So if you get $100 you'll allow yourself to spend $25 on a pizza night and the rest goes in the Emergency Fund.

If you get $500 you'll allow yourself to get a new purse and the rest goes to your retirement fund.

If you get $1000 you'll put half in the vacation fund and the rest goes to debt. And so on.

Our typical plans were:

- Under $100, go for fancy coffee, the rest ease the budget

- $100-$500, go out to a nice dinner, the rest to debt

- $500-$10,000, go out to a nice dinner, split the rest between debt and vacation fund.

- 4. $10,000 +, go out to a nice dinner a couple of times, split the rest between debt, vacation, and car replacement funds.

You'll notice we built in a little "celebration" as the first item in our plan for every level, that way we wouldn't feel deprived of enjoying the surprise money, and that helped us follow the plan.

And in case you are wondering, yes, we did actually get a surprise over $10,000! Our debt was paid off by that time, and we had saved enough for the vacation we had planned, the majority went to the car replacement fund and allowed us to get a newer SUV with cash!

If we hadn't planned ahead, who knows what silly stuff we would have gone out and got on a big shopping spree?

I bet you'll get at least one big surprise too, so plan for it!

Of course you can come up with whatever plan suits you, but do make a plan, you’ll reach your goals a lot faster if you do!

This is a great way to think about extra money received! Never thought about planning ahead. Thank you for sharing this!